Are you tired of making telephone calls reminding your clients about dues, payments and notifications on savings transactions? Loan Performer Reminders and SMS Notification is just the feature for you.

Loan Performer allows you to send periodic messages through the SMS functionality to clients reminding them of their loan obligations towards the organization for example when reminding clients of when the loan repayments are due. You will be able to set the frequency of the reminders and write the message to send, should be sent.

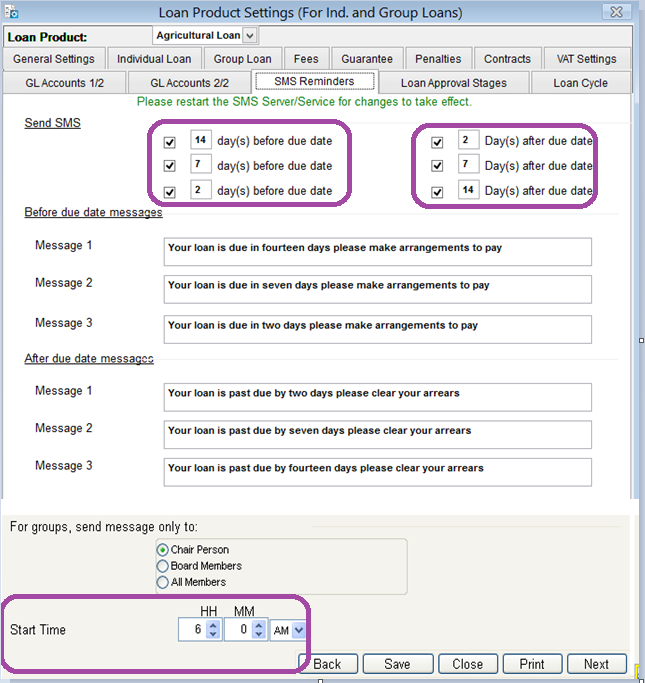

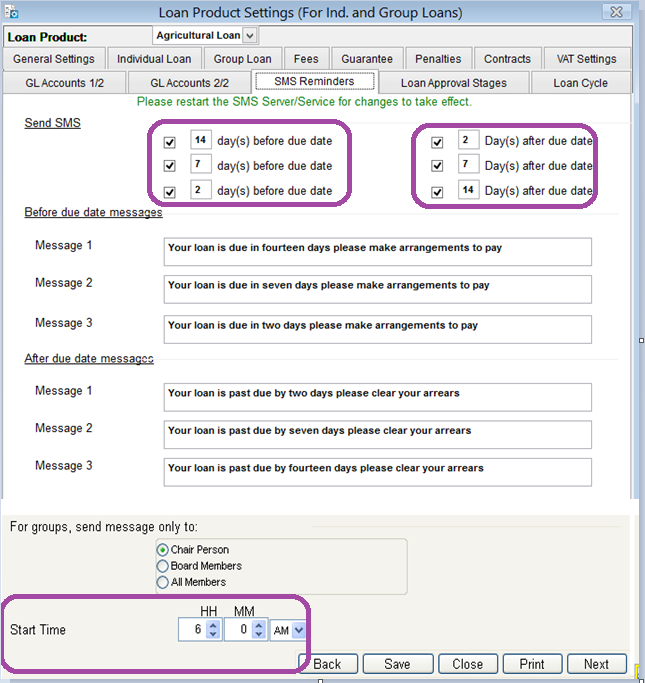

How to configure SMS reminders

To configure SMS Reminders, go to System/Configuration/Loan Product Settings/SMS Reminders, the following screen appears:

Click on the Save command button to save the settings and on the Close command button to exit the menu.

The Nº 1 Software for Microfinance